Minimum Earned Premium (MEP), or Minimum Retained Premium, is the smallest amount of money an insurance company is willing to accept for writing an insurance policy.

If a policy cancels before the MEP is paid or earned, clients can bill to obtain the MEP, or clients can issue a return premium for all money in excess of the MEP amount. The MEP must be defined and in effect before a policy's inception date for a client to bill for or retain a specific amount of premium. A setting allows clients to define a minimum amount of earned premium. Clients can define a static MEP, a calendar-based MEP, or both.

Note: For a given cancellation date, if both the statically configured MEP and a calendar-based MEP are available, then the highest of those two amounts is elected as the effective MEP.

Set up a static amount for Minimum Earned Premium

With the static MEP, clients determine a specific amount for MEP and an effective date.

- Navigate to Settings > Modules > Policies.

- Select Edit under Policy Lifecycle. A Confirm dialog box will open with the following message:

You are about to leave the page. Would you like to save your data before proceeding?

- Select Yes to save the information you added and continue to the Policy Lifecycle screen, or select No to proceed to the Policy Lifecycle screen without saving the information added.

- From the Choose a State dropdown list, select a state.

- Select one of the following radio buttons: Lifecycle Parameters Are the Same for All Business or Lifecycle Parameters Are Defined Per Policy Type.

Note: If you select Lifecycle Parameters Are Defined Per Policy Type, you will be prompted to select the policy type you're enabling the setting for.

- Navigate to Cancellation > Minimum Earned Premium.

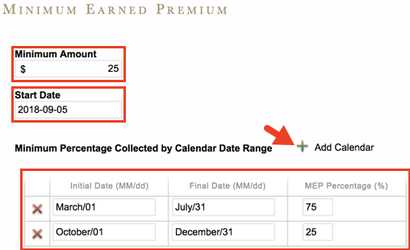

- In the Minimum Amount box, type the minimum amount the insurance company is willing to accept for writing insurance policies.

- In the Start Date box, use the date picker to select the date the MEP goes into effect or type the date the MEP goes into effect.

- Select Save or Save and Exit.

Set up a calendar based on Minimum Earned Premium

If enabled, the system will follow the defined MEP percentage if the policy's cancellation date is within the months defined.

- Navigate to Settings > Modules > Policies.

- Select Edit under Policy Lifecycle. A Confirm dialog box will open with the following message:

You are about to leave the page. Would you like to save your data before proceeding?

- Select Yes to save the information you added and continue to the Policy Lifecycle screen, or select No to proceed to the Policy Lifecycle screen without saving the information added.

- From the Choose a State dropdown list, select a state.

- Select one of the following radio buttons: Lifecycle Parameters Are the Same for All Business or Lifecycle Parameters Are Defined Per Policy Type.

Note: If you select Lifecycle Parameters Are Defined Per Policy Type, you will be prompted to select the policy type you're enabling the setting for.

- Navigate to Cancellation > Minimum Earned Premium > Minimum Percentage Collected by Calendar Date Range.

- Select the + next to Add Calendar. The Minimum Percentage Collected by Calendar Date Range table will open.

- In the Initial Date box, use the date picker to select the starting date or type the starting date for the calendar date range in which the MEP percentage will be enforced.

- In the Final Date box, use the date picker to select the final date or type the final date on which the MEP percentage will be enforced.

- In the MEP Percentage box, type the percentage of the total written premium that should be collected in the date range you established.

- Repeat steps 7 - 10 to add an additional Minimum Percentage Collected by Calendar Date.

Figure 1: The statically configured MEP with a calendar-based MEP.

Working with the start date

Typically, MEP can't apply (calendar or static) to policies bound in the past because those policies don't include a form of MEP upon cancellation, which means that legally, MEP can't be charged on those past policies. Policies with an inception date after the specified Start Date should be subject to MEP calculation.

Apply Minimum Earned Premium when canceling policies

If you set a policy to cancel immediately, you can select whether or not to apply the MEP. If a policy is canceled early in the term before the actual earned premium has exceeded the minimum earned premium, the insurance carrier will keep the minimum earned premium and refund the unearned premium.

Note: To apply MEP when you set policies to cancel immediately, you must set up a static amount for MEP or set up a calendar-based MEP. If you don’t set up an MEP, the Apply Minimum Earned Premium dropdown list won’t display in the Cancel Policy dialog box.

To apply MEP when you set a policy to cancel immediately:

- From the Policy Search screen, locate and access the policy you want to cancel.

- In the policy header, beneath the Additional Description box, select the Cancel Policy button. The Cancel Policy dialog box will open.

- From the Cancel When dropdown list, select Cancel Immediately. The Apply Minimum Earned Premium dropdown list will display.

- From the Apply Minimum Earned Premium dropdown list, select Yes to apply MEP.

Note: By default, the Apply Minimum Earned Premium dropdown list is blank. You must select Yes or No from the Apply Minimum Earned Premium dropdown list to cancel the policy.

- From the Cancellation Reason dropdown list, select a reason.

- Complete the Print Description and Additional Description. These fields are optional.

- Select OK.